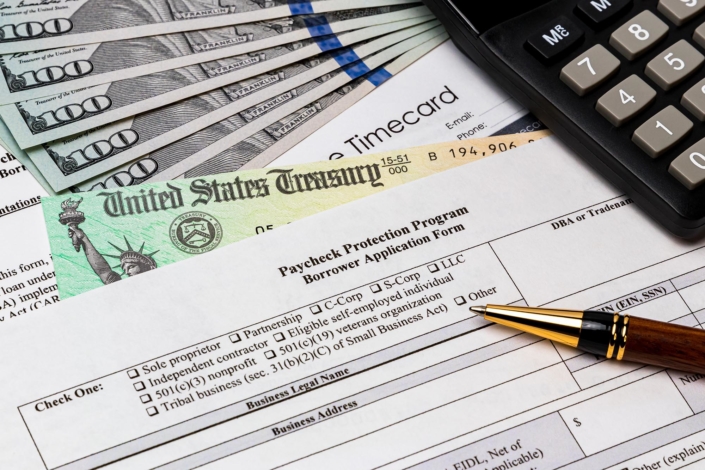

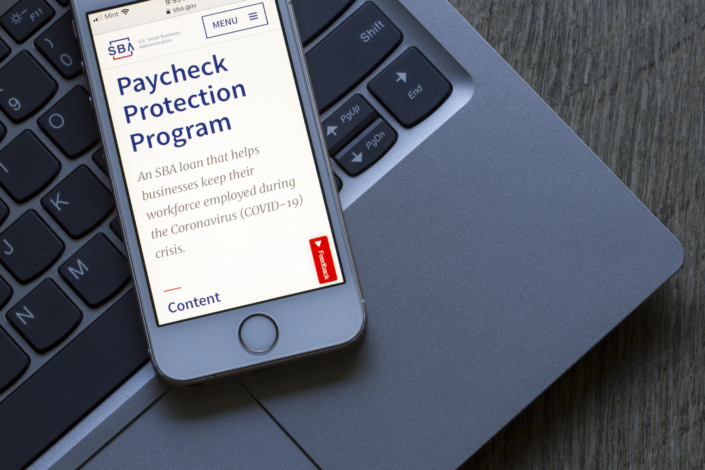

The SBA Payroll Protection Program (PPP) Loan Criteria For Forgiveness Are Changing…

The ** UPDATED** SBA PPP Payroll Tracker will help you remain in compliance with the forgiveness terms.

If your business received funds, you must track the spending in order to have the loan amount forgiven.

[asp_product id=”5312″]