Certified Exit Planning Advisor with Expert Merger and Acquisition Consulting Services

An exit strategy is when the business owner is planning to sell their ownership in a company to another business owner, another company or investors. Having an exit plan in-place gives the business owner a way to reduce or liquidate their stake in a business and, if the business is successful, make a substantial profit. Bringing in a certified exit planning advisor will help guide you through the process.

Learn how an Outsourced Accounting Partner can help you grow

WHAT DOES AN EXIT PLANNER DO?

What is “exit planning,” exactly? An exit plan refers to the process by which a business owner leaves a business. This most commonly happens when a business owner retires, sells the business, or passes the business on to a successor.

Exit planners facilitate this process by assisting with the legal, logistical, or financial steps necessary for such a transition to take place, such as helping you with tax changes that may affect the timing of your transition.

Exit planners have a responsibility to ensure that the business is maintained after the owner departs and also to ensure that the owner has the financial stability to make a well-timed exit. They can also help you find the right buyer when the time comes to sell.

Perhaps most importantly, an exit planner can help you distill your company’s core values and make sure that these values are preserved after a change in leadership. Exit planners can help you build a legacy and leave behind something you and your family can take pride in.

When Should I Start Planning For An Exit?

The answer depends on what you expect from your exit.

If you’re planning on passing the company to a child, 10 years is a good timeline to plan for other sources of income in retirement.

If you are looking at an IPO, plan around growth of $1m to $100m in 7-10 years (so you have a shot at an IPO).

If you’re hoping to get acquired by a larger company, be certain your IP is secured and your financials are in order (3 years out is ideal for best EBITDA).

Hiring Business Exit Plan Advisors

In most cases, it makes sense to hire a business exit plan advisor. At the very least, a team of exit planning advisors can provide a fresh set of eyes to help you evaluate the financial strength and trajectory of your business, such as understanding gross profits and other important data.

This is crucial when the exit strategy includes selling the business to another company. Most business owners have an inflated view of their company’s value. An independent exit planner can provide an objective business valuation based on your company’s current assets, market value, or discounted cash flow.

These may be specialized skills that you and your staff don’t possess—or that might distract you from your core business processes.

Exit planning consultants can also help you develop an actionable communication plan so that you can inform your employees, investors, and stakeholders of what the future holds. Ultimately, their services help you develop a strategy that works for both you and your company.

Benefits of an exit strategy:

Your family:

Like estate planning, devising a strategic exit ensures you’ll protect your spouse or heirs from engaging in unnecessary decision-making & tax burdens by handling these things before they have to.

Your retirement:

Practically speaking, you want to maximize the value of the wealth your business can afford you, beyond your annual salary. Maybe the goal is a lump sum that will buy a vacation home in Palm Springs; maybe it’s an annual dividend that simply allows you to live without worry. Either way, it’s important to consider your own financial goals here—after all, you’re the one who built the business.

Transition Planning:

Your employees and Board of Directors will likely work hard to help you achieve your exit goals, and it is in the best interest of everyone to facilitate a smooth business transition. If you plan ahead thoughtfully, you can create certainty and stability during the business transition.

Maximizing value & growth potential:

Whether you’re eyeing a $20M acquisition or just looking to grow aggressively, implementing tangible steps to ensure your financials and cash flow forecasting are sound will improve your outcomes.

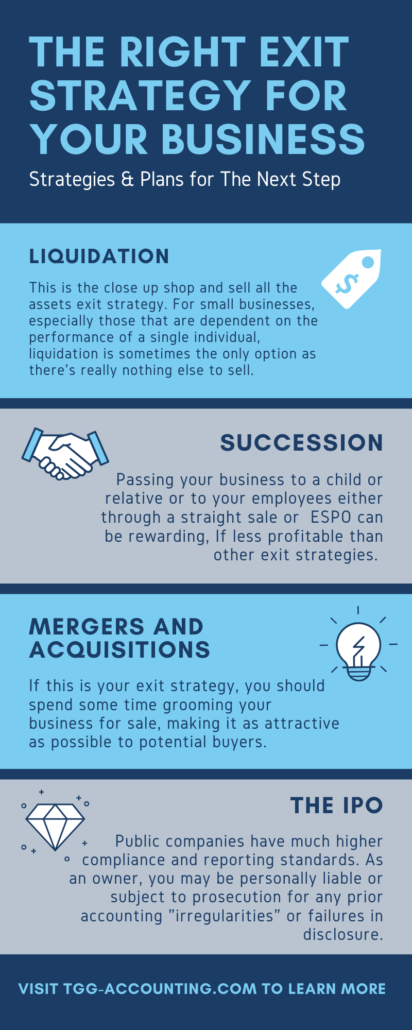

Types of Exit Strategies

Mergers & Acquisitions

This is the most common exit strategy. M&A benefits investors, founders, and equity-holding employees by offering a direct return on investment in a lump sum. Mergers and acquisitions consulting can help your company achieve the maximum acquisition value for your exit.

Initial Public Offering

An IPO means transitioning from a privately-held company to a publicly traded one. You’ll work with a bank to set the value of your company’s shares, and then hope that the market drives the value up even further. IPOs have strict SEC requirements that accompany the process and accurate financial are essential to gaining SEC approval for your IPO.

Liquidation

Typically, liquidation is not ideal. It’s often the result when there’s a lack of strategic exit planning. Certain industries do not have a robust market for M&A, IPO or succession, in those cases liquidation is the best option for an exit.

Exit Planning Services

To get started on your exit plan, you need an experienced Exit Planning Advisor and team of trusted advisors who can fully understand your goals and create a customized plan to achieve them. The best way to plan for an exit is to start early so time is on your side in case your goals, current market conditions, or the value of your business changes. Use our exit planning services will equip you with a team of experts to guide you through your exit planning and capitalize on your profit.

Exit Planning Begins with Excellent Financials

Whatever your path forward, a successful exit plan is best served by impeccable financial record keeping and the business security you will gain from letting the numbers guide your insights into your business.

The TGG Way™ implements the excellence in financial reporting that large corporations use to guide their business decisions and applies it to small and mid-sized companies, giving them the insights and decision-making certainty to plan for the future, whatever that future may hold.

HOW TO START DEVELOPING YOUR EXIT STRATEGY

What does it take to make a strategic exit plan? Exit strategy consulting will most commonly include these basic steps:

- Prepare accurate accounts of your personal and professional finances

- Consider different exit strategies (selling, transitions, etc.)

- Communicate your intention to your investors and stakeholders

- Develop an exit plan that ensures that stakeholders are repaid

- Begin transitioning responsibilities to your successor (if applicable)

- Communicate the plan and its timing to your employees

- Inform your clients of your plans

The exact strategy may depend on the nature of your plan. For instance, if you have a successor, it may make sense to transition slowly over time instead of simply retiring and introducing a new leader all on the same day.

Similarly, if you’re closing your doors for good, you may need to direct your clients to an alternative business. Otherwise, you can introduce your former customers to your company’s new leadership to ensure a smooth transition.

The Exit Planning Process

The Exit Planning Process has several steps that include the following:

- Understand the goals of the business owner(s): What would the business owner(s) like to achieve with this exit? A complete understanding of those goals will guide the entire exit planning process.

- Determine the true value of the business: Establishing the business valuation is a critical next step after setting goals because it determines whether or not the exit objectives can reasonably be met.

- Continue to build & preserve the value of the business: Create customized plans that continue to build the business’s value over time.

- Sell to a third party or transfer to management or family members: Help the owner(s) prepare for a sale to a third party or transfer plan that keeps them in control of the business until the entire purchase price is received.

- Create a contingency business plan: Consider what would happen if the owner does not live to transfer or sell the business. A plan must be put into place to mitigate this risk.

- Financial planning and estate planning: Coordination is done with the owner to make their goals a reality.

HOW TO DECIDE WHETHER TO CLOSE OR SELL A BUSINESS?

Should you sell your business or close it entirely? In most cases, it makes the best sense to sell your business. That’s because an acquisition exit strategy allows you to earn money by selling your business assets.

Even if your company is facing cash flow problems, it’s rare that a business has no value whatsoever, and the right buyer may be able to turn things around.

It only makes sense to close the business if you can’t find the right buyer or if you don’t feel confident that your core values will be maintained under new leadership. Should you decide to close your business, you can still liquidate company assets to cover any unpaid costs.

If you’re on the fence, it may help to speak with a team of exit planning advisors who can help you evaluate your business and make a choice that’s right for you.

When it comes to business exit planning, Abilene business owners will want to find a planner who understands the needs and challenges of the local community.

READ OUR CASE STUDIES:

Case Study – A Private EMS Company Brings in Outsourced Team to Assist with Significant Growth

Due Diligence Leads to Successful Sale

Case Study – A Media-Buying Agency Reaps the Benefits of Having a Team of Financial Experts

Case Study – How One Ecommerce Company Transformed Their Business and Gained Superior Visibility into Their Financial Performance

Case Studies – Scaling an Online Platform

Case Studies – Preparing for Exit

Case Studies – Start-up Concept Validation

Case Studies – Ready For Growth Phase

FAQ SECTION:

What size business is best suited for each type of exit strategy?

Mergers and acquisition agreements can be essential for small and medium sized companies. The same is true for an Initial Public Offering (IPO) when the small or medium sized businesses are in an emerging industry. Any sized business can choose to liquidate. If you’re unsure on what exit strategy is right for you, reach out to TGG, your trusted merger and acquisition consulting company, and we can help you determine the best way to move forward.

How can I make sure my company is prepared for exit?

The best answer is to have true GAAP compliant financial statements and your financials are done on an accrual basis. You should also start on your exit plan at least 3 years before you plan to sell. TGG succession planning consultants have helped dozens of businesses plan and prepare for an exit by getting their financials in order with GAAP and accrual accounting.

What is exit planning in business?

Exit planning refers to the development of a strategy that allows a business owner to leave the business. Exit planning is necessary when a company leader retires, sells the company, or closes the company entirely and can also include a succession plan for installing new company leadership.

Why is an exit plan important for a business?

An exit plan develops a focused strategy for a major business transition. It ensures that the timing of the exit is right for both the business and the owner and that all employees, clients, and stakeholders are made aware of the transition.

Most importantly, an exit plan provides an accurate valuation of the business, a vital need when selling the business to another party.

What are the skills of an exit planner?

Exit planners must possess a variety of organizational and financial skills, including:

- Team leadership

- Financial valuation

- Project management

- Communication skills

- Tax preparation and planning

Exit planners must also be capable of screening potential buyers to ensure that the company transitions to the right party.

What are the key elements of an exit strategy?

An exit strategy will commonly include these elements:

- Timeline

- Business valuation

- Communication plan

- Tax calculation and plan

- Personal plan for the owner

- Choice of exit options (closing, selling, etc.)

- Description of the owner’s values and vision

Planners can provide exit planning services while working alongside existing leadership to ensure that the final plan reflects the company mission and the owner’s vision and goals.

What is TGG’s reporting cadence?

How often does TGG send reports? Here’s what to expect: We deliver weekly reports for every client under our engagement. These include updates on budgets, completed work, upcoming tasks, alignment, and prioritization tracking or edits. Each month, we also provide financial reports covering KPIs, key metrics, goals, and overall performance. For clients who prefer more frequent insights, we can also offer weekly financial and metric reporting as an added service.